Since its launch, ERC-4337 account abstraction has been seen as a major leap toward a more intuitive and gas-sponsored Web3 experience. The industry still applauds its transformative features – smart wallets, paymasters, bundlers.

Yet, the world is changing – The bundlers supporting smart account experiences aren’t designed for tomorrow’s complexity.

Modern Web3 interactions span multiple protocols, involve complex DeFi strategies, and happen in contexts where timing, gas prices, and MEV considerations evolve by the block. In this scenario, static bundling logic creates systematic inefficiencies that lead to poor user experience and competitive disadvantage.

The platforms recognising this are replacing bundling logic with bundling intelligence. Simply stating, AI in account abstraction upgrades bundlers from their reactive mode to being proactive optimizers.

How ERC-4337 Bundlers Fall Short?

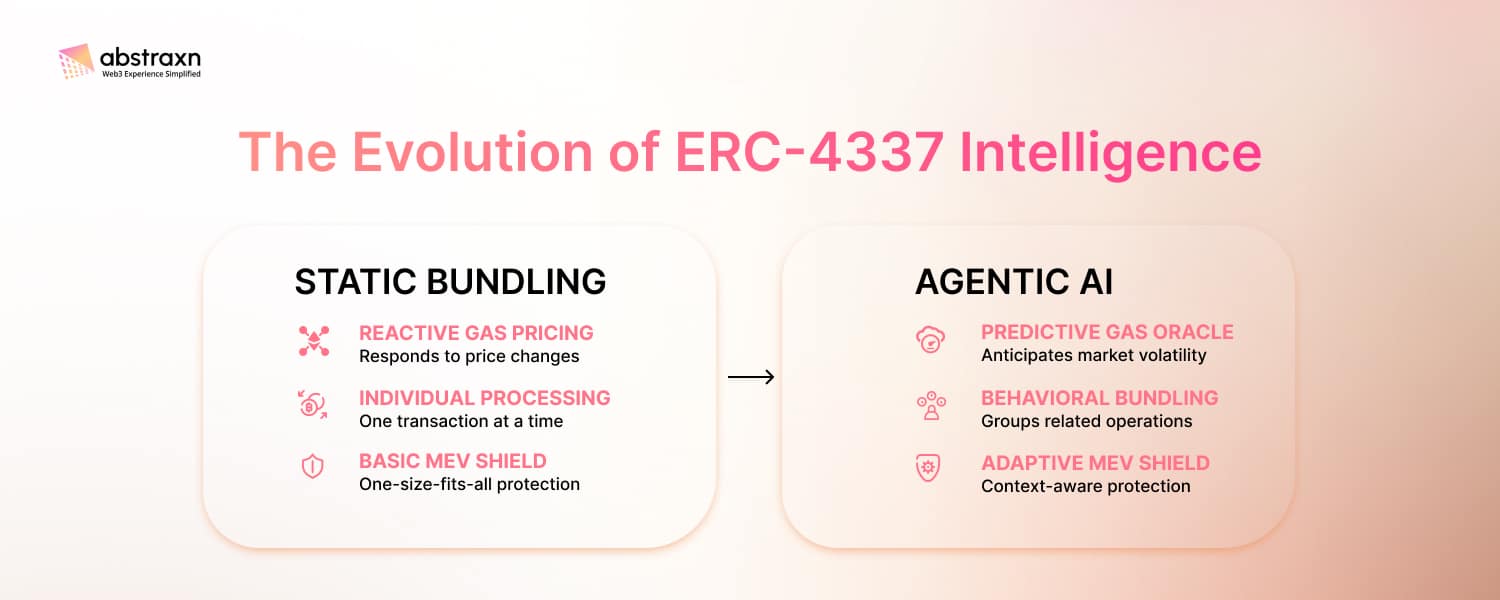

Current ERC-4337 bundlers operate on the assumption that optimal bundling strategies can be predetermined through static rules and configurations. This approach worked well when account abstraction was experimental and UserOperation patterns were predictable. But the upcoming industry requires cognitive adaptation that rule-based systems cannot provide.

The core limitation is less technical and more conceptual. Traditional bundlers utilise linear decision trees: check gas prices, validate operations, apply predefined grouping logic, and execute batches. This reactive method overlooks the dynamic optimization opportunities that build competitive advantages in the upgraded ERC-4337 account abstraction deployments.

Reactivity-driven Limitations: While static bundlers respond to present conditions, they cannot anticipate contextual changes that impact transaction outcomes. A bundler may optimize for existing gas prices while unaware of an imminent network congestion spike that is likely to render its optimization irrelevant. It processes UserOperations in submission order instead of strategic sequence, thereby exposing users to MEV extraction or suboptimal execution timing.

Rule-Based Logic Constraints: Hard-coded bundling logic becomes a liability in case of new transaction patterns or market conditions. Standard bundlers cannot adapt their strategies as per user behaviour profiles, transaction success patterns, or shifting protocol dynamics. They apply common optimization rules to contextually unique situations, creating procedural friction that accumulates across thousands of daily operations. The gas estimation problem exemplifies this constraint.

The MEV Reality Gap: Typical bundlers acknowledge MEV but cannot flexibly reconfigure protection strategies, in accordance with transaction content and market conditions. They implement blanket protection mechanisms rather than contextual optimization that considers user urgency, transaction value, and current MEV extraction patterns. This creates a false security-efficiency tradeoff.

Behavioral Blindness: Conventional ERC-4337 bundlers process transactions without understanding the user’s intent patterns. They cannot identify when a swap operation will be followed by staking, or when bridging usually precedes specific DeFi strategy execution. This behavioural blindness prevents proactive optimization that could dramatically enhance user experience and operational efficiency.

AI-enabled Account Abstraction: From Bundle Assembly to Behavioural Anticipation

AI in account abstraction transforms the core logic of how UserOperations move from intent to execution. While traditional bundlers aggregate transactions based on arrival time and gas compatibility, predictive systems execute transactions based on anticipated outcomes, user behavioural patterns, and dynamic market conditions.

Traditional bundlers process what users submit, whereas predictive bundlers anticipate what users need.

Dynamic Gas Oracle Intelligence

Bundler optimization with AI involves predictive gas pricing that goes beyond simple historical analysis. While static systems rely on network averages and basic congestion indicators, AI-driven bundlers analyse correlation patterns between mempool composition, validator behaviour, transaction types, and temporal usage patterns. The predictive advantage manifests in pre-emptive optimization. Instead of reacting to gas price changes, intelligent bundlers anticipate volatility windows and pre-set UserOperations for optimal timing. This temporal arbitrage reduces average gas costs while improving transaction success rates. Further, the bundler adapts based on user profile and contextual timing.

Intent Pattern Recognition

Behavioural prediction counts as a key advancement in ERC-4337 account abstraction optimization. Machine learning models locate recurring patterns where users carry out specific operations with predictable subsequent actions.

This behavioural intelligence enables proactive strategies. Rather than processing transactions individually, systems group related operations from multiple users, curating efficient bundles while reducing execution costs. The bundler becomes a behavioural aggregator, going beyond transaction processing.

MEV-Aware Optimization

Standard MEV protection works on blanket strategies: all-inclusive protection or operational efficiency. Intelligent bundling systems remove this false binary through contextual risk assessment and adaptive protection.

AI-backed systems analyse transaction content, timing, and historical MEV patterns to adjust protection levels in real-time. Low-value transactions get minimal protection for speed. High-value operations during volatility receive comprehensive protection, including private mempool routing and decoy strategies.

The Competitive Landscape Shift

The ERC-4337 account abstraction ecosystem is transitioning. Conventional platforms tend to optimize bundling infrastructure for faster processing, lower costs, and better uptime. But the modern platforms move towards behavioural prediction systems that anticipate user needs before users articulate them.

This shift is already visible in user experience metrics and competitive positioning through sustained platform performance observation.

Market Intelligence Signals

A recent industry report states that platforms using agentic AI and predictive analytics achieve transaction success rates above 90% during congestion, as compared to 60-70% for unoptimized competitors. The upcoming years will bring more account deployments, with meaningful AI agent adoption considerably changing transaction patterns that bundlers need to accommodate.

With users experiencing seamless and anticipatory transaction handling, platforms develop stronger loyalty and higher engagement. While there are more complex operations, fewer transactions are abandoned.

Strategic Placement

Bundler optimization with AI represents a pivotal point. Early adoption provides sustainable competitive advantages while delayed adoption risks permanent positioning disadvantage.

Platforms implementing predictive bundling today will set user experience expectations. Further, user behavioural data helps in creating stable competitive moats – longer pattern analysis enables better predictive accuracy, building self-reinforcing advantages that new entrants struggle to overcome.

The Abstraxn Shift

AI in account abstraction is not an enhancement but a continuation in the advancing Web3 space. Until now, we have known ERC-4337 bundlers as strategic nodes that can think ahead, adapt to conditions, and coordinate execution with foresight. By embedding intelligence at this layer, Abstraxn transforms bundlers from executors into active enablers of seamless UX.

Web3-Native AI: Our machine learning models are based specifically on blockchain transaction patterns, user behavioural sequences, and ERC-4337 account abstraction interaction flows. Unlike generic AI systems adapted for blockchain usage, Abstraxn’s agentic AI understands Web3 context natively.

The difference shows up in prediction accuracy for blockchain-specific scenarios: DeFi interaction patterns, cross-chain operation sequencing, gas optimization, etc.

Modular Integration Architecture: Abstraxn integrates with existing bundler optimization needs through API-first approaches that enhance current systems without requiring infrastructure replacement. Organisations can maintain operational continuity while gaining predictive optimization capabilities.

Your current infrastructure handles transaction processing while Abstraxn provides behavioural prediction, gas optimization, and MEV protection intelligence.

Real-Time Adaptation: Our systems constantly adapt to transaction outcomes, user feedback, and network conditions. Unlike static optimization rules, Abstraxn’s intelligence layer evolves as per changing user behaviours, market conditions, and protocol dynamics.

This adaptation capability creates sustainable competitive advantages. As the adoption of ERC-4337 account abstraction expands and user behaviours change, Abstraxn’s intelligence becomes more accurate and effective.

Implementation Simplicity: Organisations typically deploy enhanced bundling capabilities within days, measuring user experience improvements immediately.

The platforms implementing Abstraxn’s intelligence aren’t just upgrading their bundling infrastructure, but also establishing cognitive advantages that increase over time, creating user experiences that anticipate needs rather than only responding to requests.

Closing Thoughts

ERC-4337 gave us programmable accounts. AI gives us accounts that think. The future belongs to the platforms that ship both – ecosystems that not only execute user intent but also anticipate it, optimize for it, and deliver experiences that feel seamless. Intelligent Web3 platforms understand context, behavior, and outcome requirements.

At Abstraxn, we are committed to accelerating this evolution.