The promise of Web3 has always been about user control. Yet, for most users, that control still comes at the cost of complexity. Wallet pop-ups, gas approvals, and multiple transaction flows became the hidden burdens of adoption.

Account abstraction has emerged as a turning point. While the industry celebrated smart accounts and gasless transactions as Web3’s peak moment, something more fundamental is shifting beneath the infrastructure layer. Users began abandoning platforms not because wallets were complex, but because interactions remained cognitively demanding. The adoption of account abstraction saw its peak at 34% transaction volume in Q3 2024, then plateaued despite continued infrastructure investment.

The transition came with agentic abstraction, which started processing 10x transaction volumes with 40% fewer user touchpoints. With agentic intelligence becoming the cognitive layer of Web3, the industry has evolved from a system that users learn, to a system that learns to understand users.

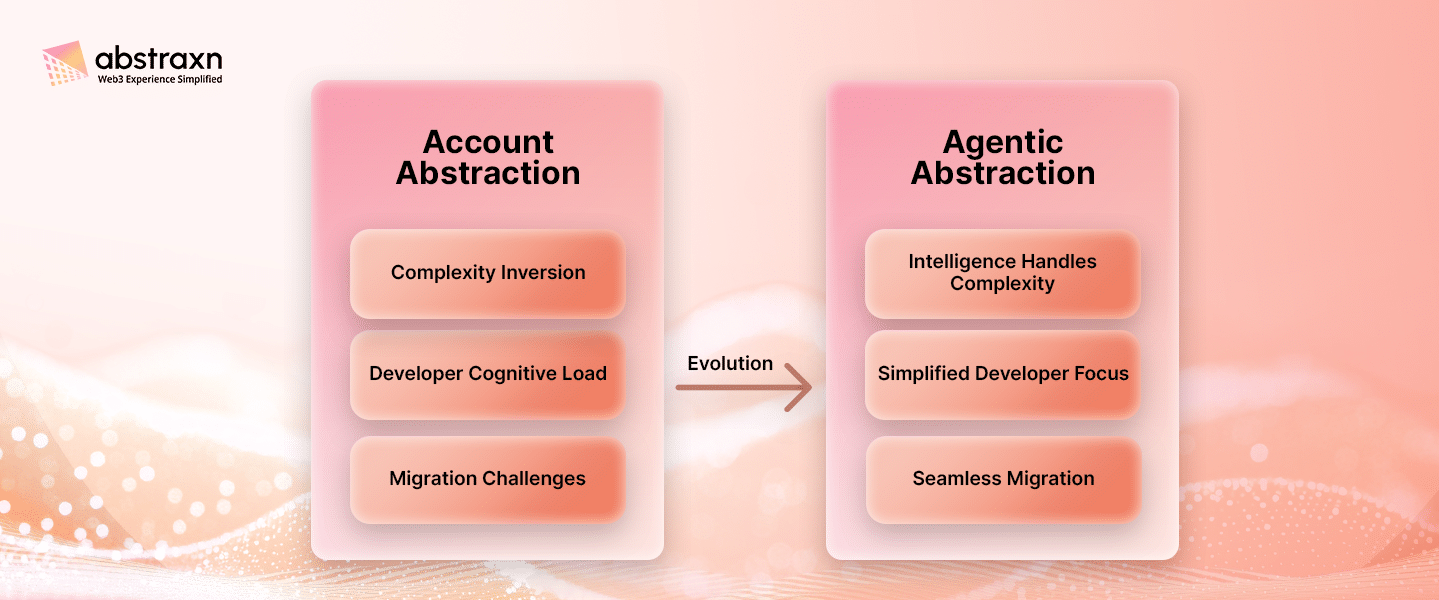

The Abstraction Evolution Spectrum

The efficiency of account abstraction was its ability to reduce friction in transaction execution – codified through ERC-4337 and its ecosystem of smart accounts, paymasters, and bundlers. As a result, the setup hustles decreased by 67%, and transaction failures from user error dropped by 43%.

However, abstraction allayed only the surface-level barriers, as there remained a key constraint – it automates execution without understanding user intent. Users are still required to specify exact parameters (slippage tolerance, bridge routes, staking strategies) that demand domain expertise.

Today, users don’t want smoother approvals; systems that anticipate opportunities, flag risks before they become losses, and guide them across protocols they are unaware of. Agentic abstraction recognizes that users know what they want to achieve, but shouldn’t need to search for the path. This distinction transforms interface design, from “streamline the specified action” to “interpret and optimize the intended outcome.”

Market forces now penalize platforms that cease to advance beyond infrastructure optimization. Enterprise buyers assess Web3 solutions against AI-supported workflows – where systems interpret high-level objectives rather than executing step-by-step instructions.

Agentic abstraction isn’t an optional enhancement – it’s the fulfilment of abstraction’s original promise.

What Makes Agentic Abstraction Different?

By embedding reasoning into the execution layer, platforms have evolved from being passive toolkits to cognitive partners. Agentic abstraction assures that decisions are faster and smarter – backed by constant monitoring, contextual awareness, and adaptive strategies. With AI, user intent becomes the interface.

A blockchain AI agent doesn’t wait for the users to approve every move – it understands the strategy behind the move. It can rebalance the user’s portfolio when markets change, protect the user from cascading liquidations, and draft a governance vote aligned with the principles stated by the user. The following table gives an overview of the key differences between account and agentic abstraction:

| Dimension | Account Abstraction | Agentic Abstraction |

| User Input | Pre-defined actions, approvals, signatures | Natural intent expressed in plain text |

| Intelligence | Transaction plumbing | proactive reasoning and decision-making |

| UX Impact | Less friction in execution | Intent-driven UX and interactions |

| Scope | Wallets, gas, transaction sponsorship | Portfolio optimization, governance, risk management, cross-chain strategies |

| Value Addition | Higher adoption through smoother flows | Competitive differentiation through cognitive experiences |

| Core Elements | Smart accounts, paymasters, bundlers | Blockchain AI agents (orchestrators, sentinels, transaction agents) |

Simply saying, account abstraction waits for users to know what they want. Agentic abstraction helps them discover what they need

The Architectural Divide: Account Abstraction Vs. Agentic Abstraction

The abstraction landscape reveals architectural constraints that limit its evolution toward agentic intelligence. Identifying these limitations explains why current market leaders face disruption from agentic AI-native platforms.

Decision Trees vs. Intent Graphs: Account abstraction processes user actions through decision trees: if-then logic that responds to specific inputs with predefined outputs. A user initiates a swap, the smart account checks for their balance, implements slippage settings, and executes. The path is quite linear and predictable.

On the other hand, Agentic abstraction constructs intent graphs: dynamic networks that map user intent to optimal execution strategies. When a user commands “optimize my DeFi portfolio for higher yields,” blockchain AI agents analyse current positions, study market conditions, assess risk parameters, and conduct multiple actions across protocols simultaneously – resulting in an adaptive and contextual route.

So, we can say that account abstraction bundles transactions but cannot optimize transaction timing as per the market volatility. Agentic AI may delay execution during network congestion, route through alternative protocols when rates change, and pause strategies when risk thresholds fluctuate.

Reactive vs. Predictive State Management: Account abstraction maintains static state – account permissions, spending limits, approved contracts. These parameters remain the same until manually updated. Agentic abstraction carries a dynamic state – learns user preferences, tracks market patterns, and updates risk assessments constantly.

In other words, agentic AI alters user experience fundamentally. While standard smart accounts entail users to anticipate scenarios and configure rules accordingly, blockchain AI agents adapt to scenarios as they appear, making contextual decisions that reflect the present conditions as well as historical patterns.

Cognitive Load Distribution: Account abstraction transfers cognitive load from wallet management to strategy formulation. Users spend less time on gas estimations and more time researching optimal parameters. Agentic abstraction erases this strategic cognitive load completely – users only need to express objectives while agents manage the tactical and strategic execution.

This shift enables Web3 platforms to serve users who lack domain expertise without compromising sophistication for power users. Agentic AI systems scale complexity internally rather than exposing it through interface design.

Why is Agentic Abstraction Easier to Deploy?

Incorporating agentic AI to Web3 platforms simplifies integration complexity rather than increasing it. This stems from the fact that agentic abstraction handles decision-making at the architectural level, removing the configuration burden that account abstraction passes to development teams.

Complexity Inversion: Account abstraction needs developers to anticipate user scenarios and encode appropriate responses: gas limit calculations, slippage tolerance ranges, multi-signature thresholds, and spending caps. Each parameter demands blockchain expertise to implement correctly. These implementations typically take 8-12 weeks of parameter tuning and edge case handling.

Agentic abstraction inverts this requirement. Blockchain AI agents tackle parameter optimization dynamically, requiring developers to map business logic rather than blockchain mechanics. Teams state user intents (e.g., “secure high-yield staking”) while agents translate them into optimal on-chain execution strategies. These integrations ship core functionality in 2-3 weeks, with agents learning and optimizing parameters through interaction with data instead of manual configuration.

Developer Cognitive Load Shift: Standard account abstraction compels developers to become domain experts across multiple areas: gas economics, cross-chain routing, DeFi protocol mechanics, and security vulnerabilities. Such requirements create bottlenecks as teams have to delve into research-optimal configurations for multiple scenarios, including the ones they may never face.

Agentic abstraction requires developers to understand user objectives and business outcomes – knowledge they already possess. For this, blockchain AI agents maintain the technical expertise, constantly updating strategies as per market conditions and protocol changes.

Migration Path Edge: Platforms with existing account abstraction infrastructure can layer agentic AI capabilities without rebuilding foundational systems. Agentic abstraction builds upon existing smart accounts, paymasters, and bundlers as execution rails while adding the intelligence layer that interprets and optimizes user intents.

This architectural compatibility eliminates migration risk while allowing for immediate capability enhancement. Teams can deploy agentic AI features incrementally, estimating impact before expanding scope, before committing to complete platform overhauls.

Use Cases Enabled by Agentic Abstraction

The progression from account abstraction to agentic abstraction unlocks use cases that static smart accounts could not provide.

Autonomous Portfolio Optimization

Instead of manually chasing yield across chains, blockchain AI agents perpetually scan markets, rebalance assets, and execute cross-protocol strategies, in alignment with the user’s intent and risk profile.

Adaptive Risk Management

Liquidations don’t happen in isolation. Sentinel agents powered by agentic AI flag exposures early, trigger protective actions, and also hedge automatically, conserving user capital without manual human intervention.

Dynamic DAO Participation

Nowadays, governance is dominated by a few. With agentic abstraction, proposals are interpreted and aligned with user preferences, counterproposals are voted or drafted autonomously, making decentralized governance absolutely participatory.

Smart Escrow & Commerce

Trades can be negotiated and settled without middlemen. Intelligent agents hold assets in escrow, validate conditions on-chain, and release funds instantly once terms are met, removing the friction of trust.

Cross-Protocol Composability

In the case of standard infrastructure, power users had to stitch together multi-step DeFi strategies manually. With blockchain AI agents, intents like “maximize stablecoin yield with minimal risk” are decomposed, optimized, and executed across multiple protocols in a single flow.

We can say that agentic abstraction isn’t just an advancement, it’s an entirely new design space!

The Bottom Line

The evolution from account abstraction to agentic abstraction is a shift from transactions to cognition, from user burden to user empowerment. The platforms that adapt to agentic AI now won’t just offer better UX; they will define the benchmark everyone else competes to meet.

Abstraxn exists to make that transformation real today. With our network of blockchain AI agents, platforms move from being utilized to being understood.

Ready to redefine Web3 interactions? Start with Abstraxn now!